Companies want to grow and be profitable, but it’s tough to achieve both at the same time. Profitability, measured with metrics like Return on Assets (ROA), might come from a more stable and less agile environment. Growth, on the other hand, could come from a strong mission, a customer-focused and adaptable approach, and more investment in employees. Let’s explore which company cultures are good for growth, which help profitability, and which cultures may be driving your company into the red.

Growth: Here’s When a Consistent Culture can Hurt Your Market Performance

Is consistency good for financial performance? Not always, when we’re talking about consistency in corporate culture.

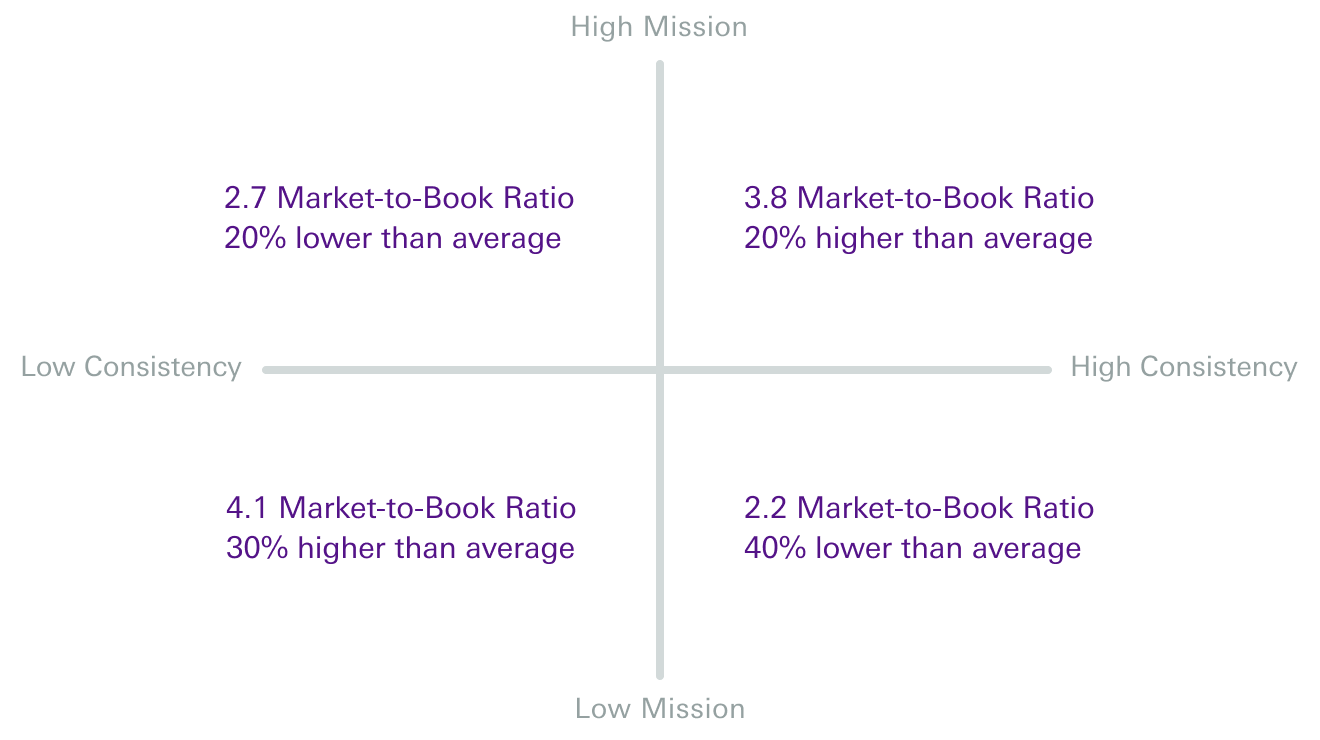

By studying over 88,000 people in 137 publicly traded companies, Dr. Dan Denison and his team discovered that company Market-to-Book ratios were worse for companies with high culture consistency and low scores on adaptability, mission, and employee involvement. This means companies with consistently low empowerment, a focus on the individual over the team, and low investment in employee skills had poorer market-to-book ratios one year later. In firms like these, employees feel less commitment, less ownership, and can’t give their input. and more like they’re taking orders from higher-ups.

When firms are reliably less adaptable and customer-focused, their Market-to-Book ratio suffered too. Consistently less mission-driven companies have poorer performance on the stock market, when they lack strategic direction, goals and objectives, and a long-term vision.

Interestingly, companies with low consistency and who aren’t mission-driven still see high Market-to-Book ratios. This might mean some pockets of the company have direction and clarity of purpose, but other business units are missing this key dimension of culture.

For public companies to get the best market performance, they should be consistent with their mission, adaptability, and employee involvement.

Growth: How Culture Helps and Hurts your Sales Growth

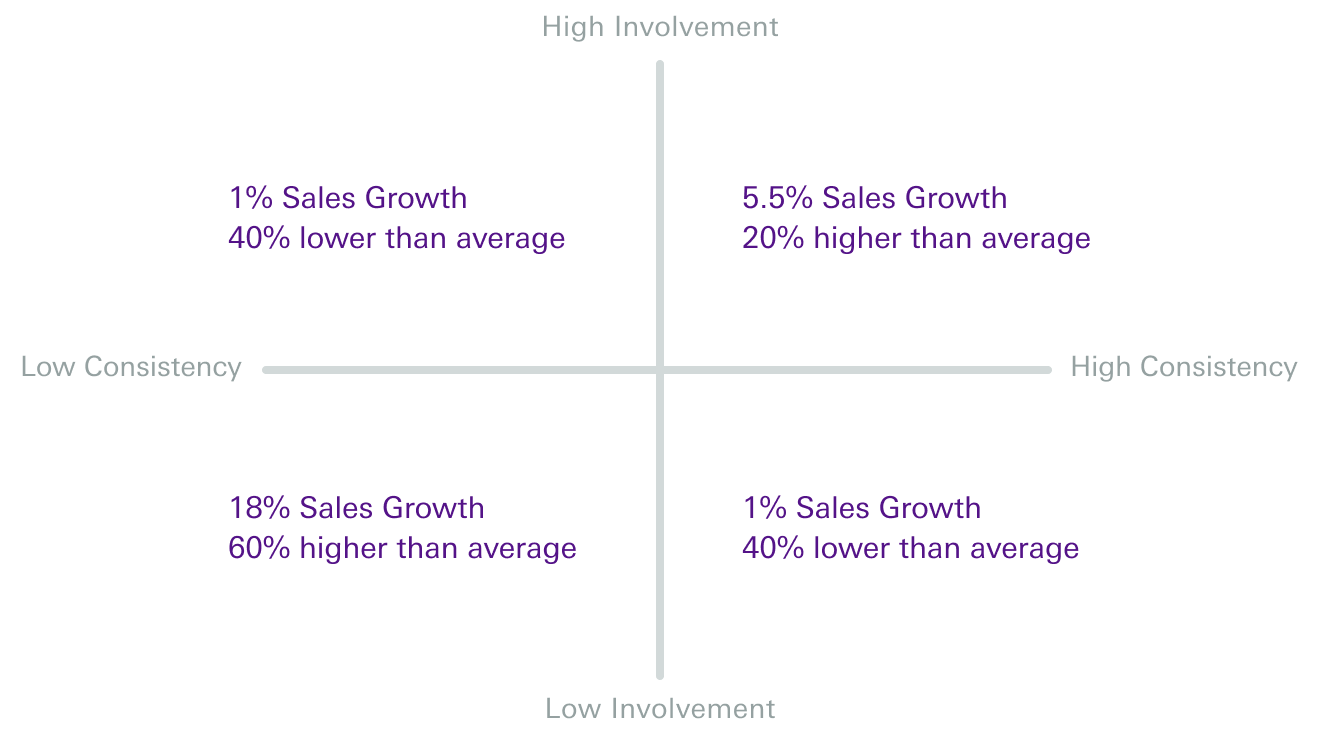

If your company’s culture is focused on employee involvement, adaptability, or a clear mission, this can help your sales growth 2-3 years on. But this only works when your company is highly coordinated and integrated.

Sales growth also suffers when companies are inconsistently focused on flexibility, their mission, or creating a team-based environment. If the company doesn’t agree these cultural elements are important, they won’t reap the benefits in growing sales. Interestingly, companies with low consistency and a low employee-involvement culture saw positive sales growth. These organizations may do well for a while, but failing to invest in employees’ empowerment and capabilities can backfire with high turnover and a negative employer brand.

Profitability: Can a Culture of Adaptability Lower your Return on Assets?

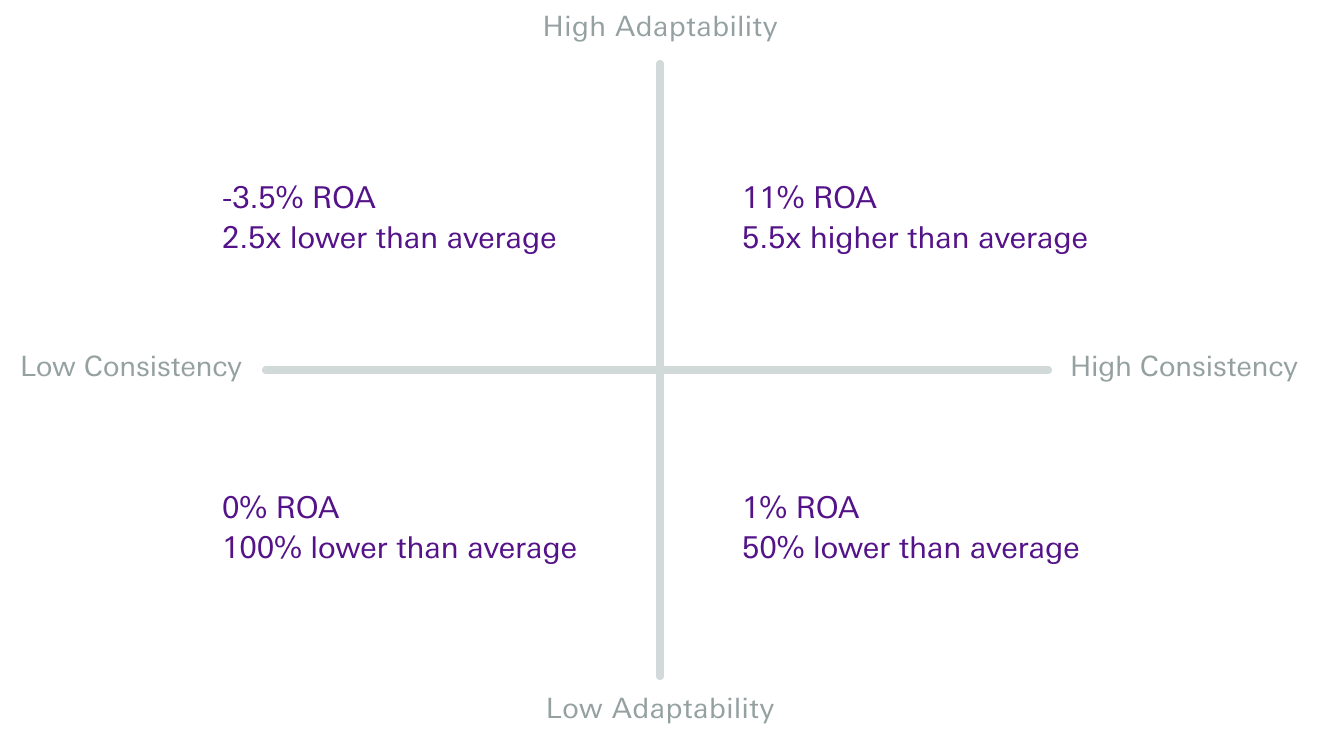

Return on assets (ROA) is a clear measure of a company’s profitability. For companies focused on maximizing ROA, they are best served by maintaining a culture of high consistency and low adaptability. Of all the ways companies can combine adaptability and consistency, a high consistency, low adaptability culture provides the greatest ROA.

Why might this be happening? Company and market stability might play a role. In the short term, companies that focus internally and are less flexible could be more profitable and have higher ROA. Yet over the long term, ignoring outside forces can backfire, turning a firm’s blockbuster products and services obsolete.

While this fascinating organizational science research only covered publicly traded companies, the results were consistent across many areas. The firm’s industry, the year (between 1995-2005), the size of the organization, the number of workers who responded, and the amount of assets the company had all had no impact on the relationships between culture and company financial performance. This means culture has a consistent, measurable impact on public companies.

We can see that in the long term, companies benefit from having consistently positive cultures focused on employee involvement, being mission-driven, and adapting to changes outside the business. It’s not helpful to have consistently strong values built around bad people practices. If this is happening in your company, changing your culture for good requires first deconstructing the strong forces that are keeping bad practices in place. Then, your organization can establish best practices including a customer focus, strong goals and objectives to support your long-term vision, and a team-based organization that involves employees in key company decisions. In the years following a successful culture change like this, you can look for higher growth in your sales and Market-to-Book ratio.

Want to dive even deeper?

Check out “Do consistent corporate cultures have better business performance? Exploring the interaction effects”